Welcome to my "What You Should Know About Getting A Personal Loan Online" article!

When people want extra cash, they borrow money. Most people turn to credit cards or home equity loans, but some prefer personal loans.

A personal loan is borrowed money that is usually unsecured. The funds obtained from a personal loan can be used to just about anything.

Apart from traditional banks, you can apply for personal loans through online lenders. If you are thinking of getting a personal loan, make sure you understand the vital information about it.

This is to make sure that you are only borrowing what you need and that you can pay back what you borrowed.

Below are the other things you should know about getting a personal loan online.

What is a personal loan?

A personal loan is borrowed money from the bank, lending companies, or online lenders that you will pay in monthly installments.

Moreover, it is usually payable within 2 to 5 years. It can be used for any reason that you can think of, unlike in car loans where the money is intended only for cars, or student loans where the money is designed for education.

Typically, a personal loan is unsecured or without collateral. However, there are also personal loans with collateral as security. These loans are generally easier to apply for than car loans and home loans.

Smart reasons for obtaining a personal loan

There are several reasons for obtaining a personal loan. You may be thinking of spending for your dream wedding, home remodels, starting a business, or any other legal reasons where you want to spend money.

However, you might not have the funds to pay for them. So obtaining a personal loan might be the perfect solution.

#1 To pay for existing credit

Having multiple credits may lead you to miss on-time payments and getting drowned in more interests that will likely hurt your credit score. Juggling numerous loans from numerous creditors can be difficult to manage.

Getting a personal loan to pay off multiple debts, called debt consolidation, can help in making payments on time since you will only be paying once a month. Plus, the interest is lower, and your credit score will increase.

#2 Remodeling your home

Having an outdated home can make you want to update its design. You might want to remodel your kitchen or bedroom, which can be costly.

If you don’t have sufficient funds, you can have a home equity loan or a personal loan. However, you might risk losing your home if you get a home equity loan. Thus, a personal loan might be the perfect loan for you.

#3 Starting a business

If you need to jumpstart your business and your current savings are not enough, then getting a personal loan is a good idea instead of getting a commercial loan.

Some business owners even obtain personal loans if they are not qualified for a business loan.

Obtaining a personal loan for business is suitable for startups. It also has a predictable monthly payment since the monthly installment is already fixed.

Plus, you don’t need to incorporate your business to obtain a personal loan. Incorporating is creating a new legal entity where liability is no longer personal.

#4 Emergency expenses

Not all expenses are expected and thought-through. Some unexpectedly happen and need to be done right away.

Sometimes, health insurance is not enough to pay for hospital bills, your roof needs repair, or your car needs to get a major fix right away.

Many online loans, like CreditNinja loans, offer loans that are funded one business day after approval. This scheme is perfect if you need funding right away to pay for your emergency expenses.

#5 Personal events

Spending for events like wedding, birthday, or funeral can be pricey. Your available money might not be enough to fund these events.

So obtaining a personal loan might be perfect for you. Once you have the funding, you can pay for the venue, food, drinks, and sometimes transportation.

Do you know what's better than obtaining a personal loan? EARNING YOUR OWN MONEY!

With this program, you can earn a 4-figure monthly income!

Check it out!

Types of personal loan

There are two main types of personal loans; secured loans and unsecured loans.

#1 Secured loan

Taking out a secured loan means having collateral as a security to the lender that the borrower will repay them.

The usual assets used as collateral are houses, cars, and other properties that have monetary value or higher than the amount you are borrowing.

As long as you keep paying your agreed monthly installment, you get to keep your collateral. However, if you miss a payment, then there is a risk that your lender will seize your asset, through foreclosure, set as collateral.

#2 Unsecured loan

An unsecured loan is not secured by collateral. This loan is the most common personal loan. In this loan, there is no risk of losing your asset. The credit company cannot garnish any of your assets.

The only thing that secures your loan is your credit score and creditworthiness. However, getting approved for this loan can be harder than in a secured loan.

Whenever you miss a payment, it will reflect on your credit score and credit report.

When this happens, your future lenders will take a second thought about your application. Any kind of loan default will hurt your credit score. Furthermore, the credit company can file a lawsuit against you to collect money.

Factors to consider

When applying for a personal loan, you want to extend the chances of getting your application approved.

Lenders make decisions based on different factors. To make sure that your application will have a big chance of approval, you have to consider the following factors.

#1 Your income

Lenders want to make sure that their debtors will pay them back, that’s why they check the borrower’s income, assets, and work history. They always prefer someone who has a stable income than someone who has none.

Showing proof of employment and payslip will assure the lender that you can pay back your debt.

To determine your capacity to pay, the lenders usually compare your debt with your income or the debt-to-income (DTI) ratio. This ratio is computed by dividing your total debt monthly payments over your monthly income.

For example, if your monthly debt bill is $50 and your monthly income us $100, then your debt-to-income ratio is 50%.

The highest DTI that a borrower can have is 43% to get a good chance of getting approved. However, lenders require that your ratio will not exceed 35%.

A low DTI ratio shows that you have a good balance between your income and monthly bills. Having a low DTI means more chances of getting approved.

#2 Your other debts

It’s not only your income that affects your chances of getting approved, but also your other debts. If you have other debts, there is less likely a chance of paying for another loan. Here, your credit utilization ratio is measured.

Your credit utilization ratio is measured by dividing the revolving credit you are currently using over the revolving credit that is available for you to use.

For example, if your current debt is $30, and your credit available is $100, then your credit utilization ratio is 30%.

A low credit utilization ratio shows that you haven’t used up most of your credit available.

Which means there is more room for more credit than what you are capable of paying. It is recommended to keep the credit utilization ratio below 30%.

Why do you want to have a loan that you will just be paying for in the future, when you can earn money online?

This program is the reason why I am now earning a 4-digit monthly income! Check it out!

#3 Credit score

The credit score is the most crucial factor in obtaining a personal loan. This determines the amount you can borrow, or if you can borrow any at all.

Your credit score can be from 300 to 850. Getting more than 800 credit score is considered perfect. Most credit lenders require a 660 credit score to approve a personal loan.

The five main components of your credit score are your repayment score, credit utilization, credit history and age, and new credit.

The higher your credit score, the lower the interest you can get in your credit. To increase your credit score, you must decrease your credit and pay your debts on time.

Lenders want to be sure that you will be responsible for the debt you are applying for. That’s why they look into your payment history.

Having missed payments will be seen as a red flag on the part of the lender. Thus, it is important to enhance your credit score.

How to obtain a personal loan

Whether you consider obtaining a personal loan from a bank, credit union, or online lender, the process and requirements are usually the same.

The general requirements are employment checks, employment history, and address. But you also have to check your credit score and credit report.

Check your credit score

Most, if not all, lenders will check your credit score to determine how likely you are going to pay for your loan.

As mentioned above, make sure you increase your credit score by paying your loan on time and reducing your debts.

Review your credit report

It is also essential to review your credit score and check for any inaccuracies and errors.

Whenever there are errors, “dispute” them by asking for a revision of these errors, this includes information on your credit accounts, current balances, payment history, and total debt.

Consider your options

As mentioned above, you can choose between a secured loan or an unsecured loan.

Depending on your financial situation, you might need a cosigner who will be liable if you fail to pay your credit.

You also have to think about where you will apply for a personal loan - bank, credit union, or online lenders.

Shop around for your personal loan

One thing you also need to do is not settle for what is first offered to you. If you do, then you might miss a lender that can provide a lower interest rate.

Shop around for any lender that provides an economical interest rate for your needed loan.

Provide necessary requirements

Aside from the requirements mentioned above, you might be required to provide for further requirements that need to be faxed or mailed to them.

The faster you provide for the needed requirements, the faster the response will be for your loan application.

Wait for a confirmation

After submitting the requirements, you should wait for the approval of your loan application. Once approved, wait for the availability of the money.

CreditNinja loans usually arrive one business day after approval. Personal loans are either deposited in your account, or you personally go to the lender to collect the money. The money is issued in a lump sum.

Takeaway

Now that you know how to obtain a loan and its consequences, you should make a smart decision before applying for it.

Only consider getting a personal loan when you have no enough money to fund your expenses. Always be prepared before deciding to apply for one.

Thank you so much for reading my "What You Should Know About Getting A Personal Loan Online" article! If you have comments or questions, please leave them on the comment section below!

This is How I Make Money from Home!

Obtaining a personal loan can be good if ever you need money urgently. However, that is a lot different than earning money, right?

When you apply for a loan, you will still have to pay for it. Unlike earning your own! With that being said, let me share to you how I make money from home! It is called affiliate marketing.

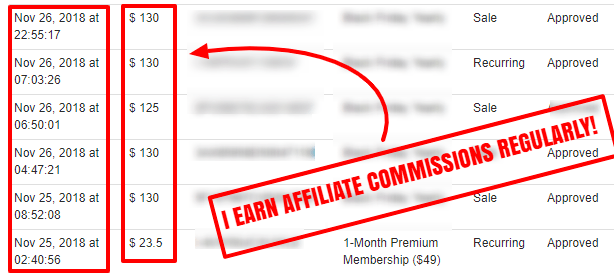

Basically, you will just have to promote products and services. Whenever people check them out or purchase them, you will earn commissions! Simple, right? Moreover, affiliate marketing is a great source of passive income!

Now, don't be intimidated with all of this because I have my best recommended training program, Wealthy Affiliate.

It is composed of a community of professional affiliate marketers who are willing to help you out!

Moreover, you can receive a lot of benefits. Some of them are:

Complete and comprehensive step-by-step training

A lot of affiliate marketing tools and materials

24/7 support

A live one-on-one chat with professional affiliate marketers

And many more!

My November affiliate commissions thanks to Wealthy Affiliate!