Hello! Welcome to my "Bankrupt? Here’s How You Can Still Apply for Loans" article!

Applying for a loan is one way to relieve ourselves from the burden of financial problems. And although loans come with risks of their own, it’s comforting knowing that if we needed it, we could ask a considerable amount of money from someone. Besides, as long as you’re responsible with your payments, hardly anything would ever go wrong.

The thing is, life can throw us into an unexpected curve. We might lose the job we have or the business we’ve own or have unexpected emergencies that cause us to need a lot of money. And because of prioritizing the immediate needs of ourselves and our families, paying off debt may take a backseat for a second.

If the debt is too much to handle, a borrower can relieve himself/herself through filing bankruptcy. To some, it might be the best option they can take to lessen their debts. However, can someone still apply for a loan despite being labeled bankrupt?

What is Bankruptcy?

Unlike the popular belief, being officially bankrupt isn’t as simple as having no money to spend. Bankruptcy is the name for a legal process that allows you to relieve yourself from debts.

However, only individuals and businesses who are unable to pay their debt are the ones allowed to apply. So no, you can’t just ask for bankruptcy to avoid those monthly installments.

Going bankrupt isn’t generally a bad thing and is not the end of your world. This process forgives debts and allows people to start anew.

Never go bankrupt again by being financially secured with this program!

With it, you will be earning a passive income up to a 4-digit monthly income!

Check it out!

Borrowers go debt-free, but lenders can still get their money back through the individual’s assets that can be liquidated. It’s a win-win situation for both parties unless you don’t count the sense of loss a borrower might feel after getting their properties liquefied.

The downside of bankruptcy, however, is how it affects your credit score. Having the label bankrupt in your credit report can cause your credit score to plummet. It can take seven to ten years for a bankruptcy to stay.

However, defaulting on your debts and allowing it to go to collections will still cause your score to drop, so it’s best to choose the lesser evil.

Can I still Take Out A Loan After Going Bankrupt?

The answer is yes. You can still apply for loans even after going bankrupt. Individuals who have filed for bankruptcy can take out a loan

And although it might affect a lender’s decision to let you borrow money, it can still be doable. However, there are some steps you need to take first before you can apply again for a loan in confidence.

There are two types of bankruptcy. The kind you can and up with can significantly affect the possibility of you getting a loan.

Although loans exist, you can always secure yourself by earning money online! You can have a 4-figure monthly income with this program!

The first one is the Chapter 7 bankruptcy in which your debt gets entirely wiped out with some of your assets liquefied. However, this type of bankruptcy can last up to 10 years on your record.

Another type of bankruptcy is Chapter 13. In this type, the court won’t forgive all your debt in exchange for assets.

Instead, you will be placed in a repayment program that will require you to pay off your obligations that would usually last for three to five years. Unlike Chapter 7, this type will only stay on your record for seven years.

What Can I do to take out a Loan?

Take your cue from the following:

Manage and Check Your Credit Score

If you’re the type who doesn’t regularly check their credit score and reports, then maybe it’s time to do so, especially now that you have a record of bankruptcy under your name.

Keep track of the debts you have and their status after cancellation. If you have a Chapter 7, there should be no balance in your credit report.

Find a Source of Income

Lenders will likely let you borrow money if you find yourself a steady source of income first. Provide detailed proofs about how much your income is, and that it can pay the loan you plan on taking despite the bankrupt status.

Include as many sources of income as possible, only if you have them, though.

Look For Loans that You Can Apply for

Many loans out there are easier to apply for compared to others. Whether it’s because of fixed interest rates or leniency on purpose, try to look for loans that do not heavily rely on credit scores for evaluation.

A bad credit loan is an umbrella term for different kinds of loans that can still be applied for despite bad credit score and report.

Never fear about going bankrupt again with this program!

It will certainly help you like it helped me! No need for loans! Check it out!

Are you planning to get a Loan?

If you’re someone who just went bankrupt or in dire need of money, you can try and scour the internet for trustworthy online lending sites.

These sites process loan applications through the power of the internet and technology, just like Creditmade Simple.

With this platform, you can apply for loans at the comfort of your own home, with whatever credit score you have. Just visit their site to learn more.

Takeaway

Bankruptcy isn’t the end of the world. To others, it’s a better choice than running away and defaulting on their loans. Just because you’ve filed for bankruptcy doesn’t mean you can no longer apply for loans.

Sure it will stay on your record for years, but with a bit of hard work, you can build your credit score once more and prove your eligibility for a loan.

Thank you so much for reading my "Bankrupt? Here’s How You Can Still Apply for Loans" article! If you have comments or questions, feel free to leave them below in the comments section!

This is How I Make Money from Home!

Although you still have options to get a loan when you are facing bankruptcy, it is still a lot better to be financially secured, right?

Today, we can already earn money online! Here is the method on how I do it! It is called affiliate marketing and it is a great source of passive income.

Basically, I just promote products and services on my website. When people buy them, I earn commissions! You can do it! Anyone can! Do not worry if you do not know how and where to start.

Wealthy Affiliate, the best program for affiliate marketing, is very much willing to help you!

It is composed of a community of professional affiliate marketers who are willing to help you out!

Moreover, you can receive a lot of benefits. Some of them are:

Complete and comprehensive step-by-step training

A lot of affiliate marketing tools and materials

Sales funnel page and other pages builder

24/7 support

A live one-on-one chat with professional affiliate marketers

And many more!

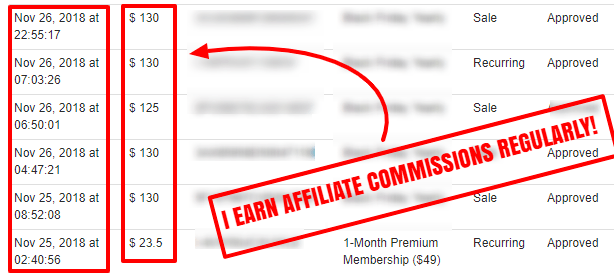

My November affiliate commissions thanks to Wealthy Affiliate!